The Paycheck Protection Program (PPP) Lifeline in the Pioneer Valley

With the economy heading for a cliff the second week of March, none of us knew what to expect. At least initially concerns over the health impacts of COVID-19 took center-stage, as Massachusetts employers responded to this unprecedented shock to our economy.

Policy makers quickly recognized that public health considerations needed to take precedent—at least for a while—resulting in a body blow to the national economy and the economies of every state. Most states took measures to at least partially close down their economies to all but “essential services”. Here in Massachusetts, Governor Baker ordered the closure of non-essential service businesses as of noon, March 24th, 2020, two weeks after declaring a state of emergency throughout the Commonwealth due to the Coronavirus outbreak.

At the federal level, the bipartisan CARES Act that was signed into law on March 27, included several provisions to soften the blow for businesses and individuals harmed by the economic shutdown. The establishment of federally backed loans through the Small Business Administration (SBA), in the form of the Paycheck Protection Program [https://www.sba.gov/funding-programs/loans/coronavirus-relief-options/paycheck-protection-program] was one of the most substantial elements, a $650 billion initiative intended to help businesses survive and their employees continue to make ends meet.

Throughout the Pioneer Valley, thousands of businesses (8,673) were extended loans through the PPP, allowing them to retain an estimated 100,1001 workers (36,000 via loans of less than $150,000, and 65,000 via loans of $150,000 or more).

Because the publicly available information for PPP loan recipients is different for smaller loans (those of less than $150,000) than for loans over $150,000, determining the precise allocation of loan funds is not possible. We know that $257.6 million was distributed to Pioneer Valley businesses through loans of less than $150,000, and the amount allocated in increments above $150,000 totaled between $493.2 million and $1.2 billion.2

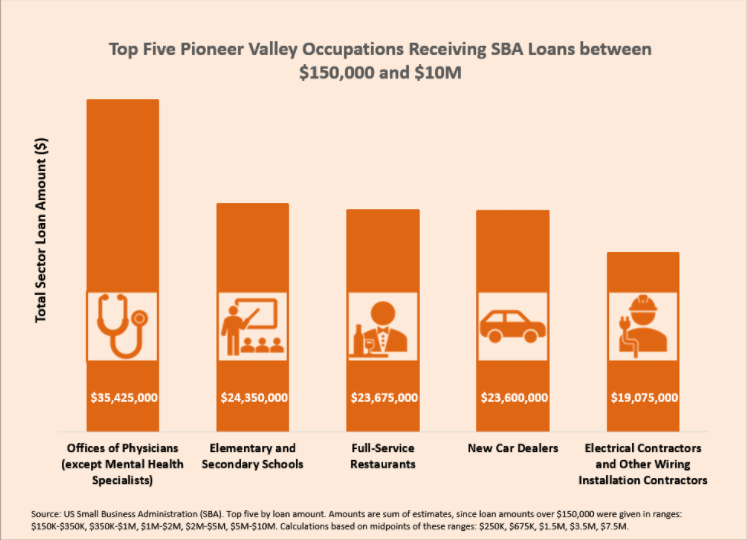

Among recipients of loans ranging from $150,000 in value to $10 million, offices of physicians, elementary and secondary schools, full-service restaurants, new car dealers, and electrical contractors received the largest sums through the PPP program, as seen in the accompanying figure.

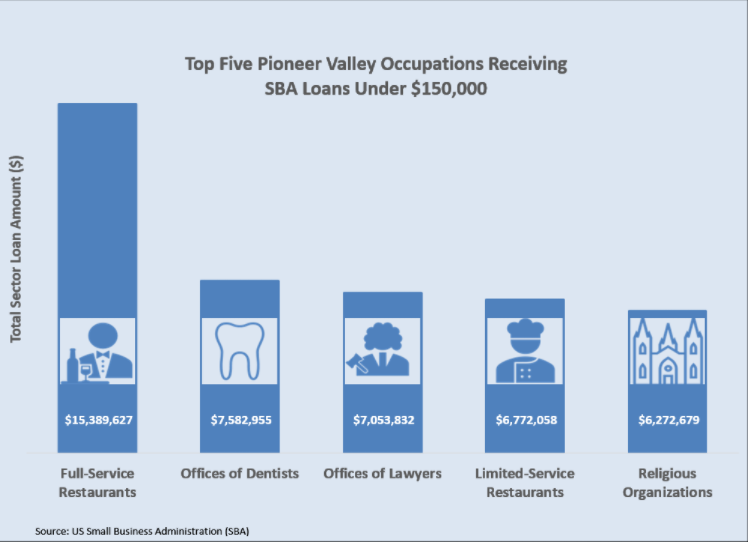

Among recipients of loans less than $150,000, sectors receiving the largest total loan amounts include full-service restaurants, dentist offices, lawyers offices, limited service restaurants, and religious organizations.

Although the deadline for filing PPP loan applications has been extended beyond the initial deadline (from June 30, 2020 to August 8, 2020), most recipients are now navigating the process of seeking loan forgiveness. As the US Chamber of Commerce notes [https://www.uschamber.com/report/guide-ppp-loan-forgiveness] in their guidance to business seeking loan forgiveness, the key requirement to be eligible for loan forgiveness is that the funds were allocated as outlined in the original loan application, and that at least 60% of the loan went to support wages of employees of the business. Here in Massachusetts, the Massachusetts Equitable PPP Access Initiative, a coalition coordinated by LISC that came together to provide assistance and guidance to “underbanked businesses and historically disadvantaged and underserved demographic groups, including businesses owned by women and people of color” [https://www.lisc.org/boston/covid-19/massachusetts-equitable-ppp-access-initiative/] has been continuing to work with businesses as they navigate the process of requesting loan forgiveness.

As the program approaches the August 8 date for closing applications, negotiations between Congressional leaders and the White House over the existing program and possible extensions have been taking place. For Massachusetts businesses that continue to struggle, their short-term viability may depend on the outcome.

1 The estimated numbers of jobs retained are based on the applications submitted by business owners, and have not been corroborated by the SBA at this time.

2 For our purposes, we assume loans at the midpoint between those extremes, totaling $849.1 million.